year end accounts deadline

If you restart a dormant company. Year-end deadlines were discussed during the AFR Year-end coordination meeting on Thursday July 15.

Llp Annual Return Filing Compliance Due Date Vakilsearch Blog

Prepare a closing schedule.

. 3 to 6 months late 750. Friday February 25 2022. QuickBooks Financial Software For Businesses.

File first accounts with Companies House. FY22 invoices submitted by 500 pm. Masons Fiscal Year ends on June 30 2022.

Account Reconciliation Letters of Representation. Jennifer Mayes 972 883-4788. Division Accounting will submit final draft 2020 financial reporting to all divisions.

Accounts Payable will stop posting invoices for fiscal year. Ad 200 Bank Account Bonus Offer With Qualifying Direct Deposits. Ad Get Complete Accounting Products From QuickBooks.

Already extended your accounts deadline. At the end of your companys first year. Thursday 616 will be posted to the GL by COB Thursday 623.

Deadline to review 2021 activity. This means the deadlines are easier to. Information is presented both in calendar and list view.

Vendor Invoices must be received in Accounts Payable by 500pm on Wednesday July 6. Year End Deadlines. Dates may be updated based on.

You must prepare the partnership accounts within a period of 9 months after the end of the financial year. The year-end close presentation is available for download. The year end accounts provide invaluable information about your business.

Toni Stephens 972 883-4876. 26 rows The GLT e-doc does not have a year-end version. Last day to request changes to information reflected in the Year-End 2021 Financial Reports.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Closing Deadlines and Submission Information. There is no requirement that non-control accounts operating accounts in KFS end the fiscal year with an income variance of zero but if departments want to see income budgets equal actual income on FY 21-22.

21 months after the date you registered with Companies House. Employee Travel and Reimbursement Fiscal Year-End Updates. You will need to file your company tax return also known as the CT600 form online.

You can see if the margin on your sales prices is set appropriately and how the latest performance compares to last year. If you miss the deadline for completing accounts year-end or filing your company tax return you could face fines from HMRC. Learn More About Our 200 New Bank Account Bonus Offer From Wells Fargo.

Week of March 1-5 2020. Last day to request changes to information reflected in the Year-End 2021 Financial Reports. Account Reconciliation Letters of Representation.

164 Deadline for delivering and publishing partnership accounts. Depending on the size of your company you. Instead choose Closing to post.

Cheryl Friesenhahn 972 883-2489. To do this you will need your company accounts and your corporation tax calculation. For example companies with a 31st December 2020 year end will have to file their accounts by 30th September 2021.

If an invoice or expense report is. To file annual accounts with Companies House. If no requests for changes have been received Division Accounting will proceed to close the year and generate final draft reports for your records.

Any 2020 revenues andor expenses submitted after January 22 2020 will be recorded in 2021 budget. All Online Accounts Payable Check Requests must be submitted and fully approved by 1000am on Tuesday July 5. Filing Company Year End Accounts with HMRC.

Rated The 1 Accounting Solution. Create a calendar with target dates to avoid missing any crucial deadlines. Accounts Payable AP including Non-employee reimbursements Initial AP Cut-off.

Generally speaking the fines will follow these guidelines. The amount of the fine will depend on how late you are and how serious the offence is. Thursday 616 at 500 pm.

Identify the important dates and the activities that must be completed by each. 1 3 months late 375. With proper planning and the right tools however the accounting.

These include reporting and data processing deadlines and the fiscal close date. Data available to Tubs on Friday morning 624 in HDW. We encourage departments to begin planning purchases andor payments to ensure that supplies equipment and services paid from Educational and General EG.

Year-end deadlines were discussed via Teams Live event on July 14. Find a Dedicated Financial Advisor Now. Jennifer Mayes 972 883-4788.

Ad Do Your Investments Align with Your Goals. Retirees must take withdrawals from their 401ks. The year-end closing is a challenging process for the entire accounting department.

Movements in sales and expenses are laid bare allowing you to make better decisions in the future. The accounting team works longer hours and faces a number of additional deadlines. Expenses must be recorded in the year they are incurred not invoiced paid or budgeted.

Contributing to a 401k plan can save you thousands of dollars on your 2021 tax return but you need to meet the year-end contribution deadline. 9 months after your companys financial year ends. 25 rows Year-end Deadlines.

You will also need to file a directors report unless your company is a micro-entity. Please review the important fiscal year-end close deadlines and dates below. Accountants must complete the day-to-day work on transactions and perform other tasks to close the books.

To assist with your fiscal year-end planning the important transaction submission dates are listed in the table below. Gather outstanding invoices receipts.

Annual Accounts Italian Business Register

Business Tax Deadline In 2022 For Small Businesses

When Are Taxes Due In 2022 Forbes Advisor

Solo 401k Contribution Limits And Types

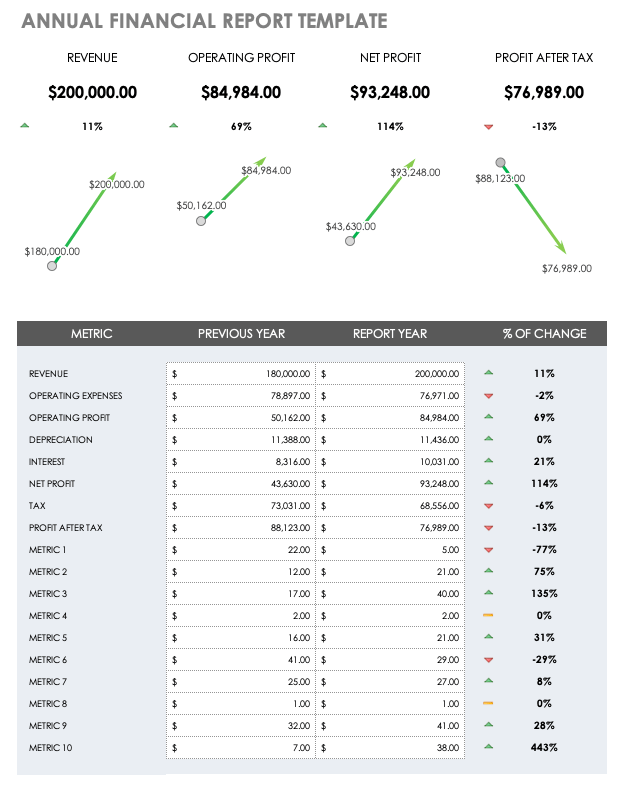

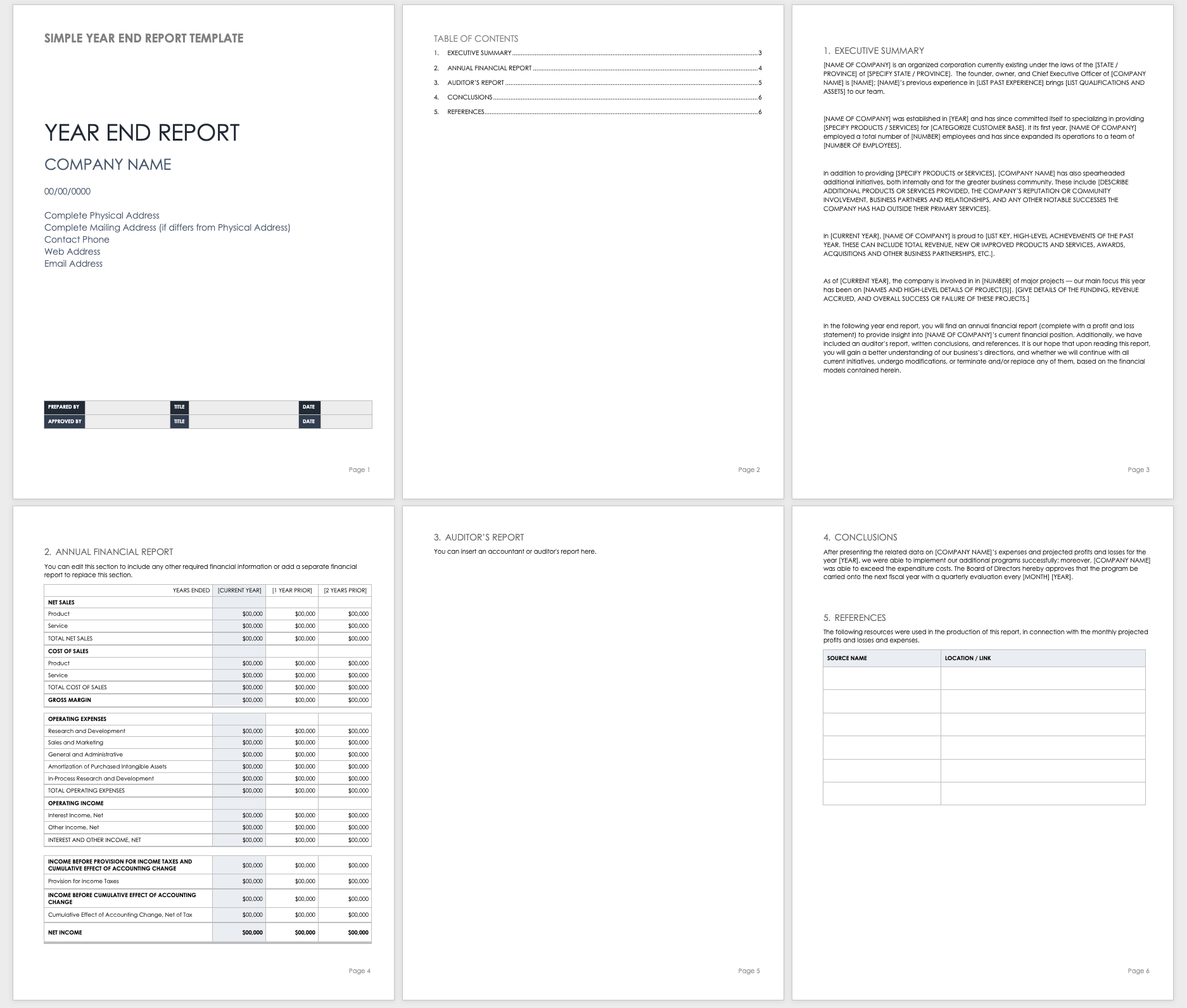

Free Year End Report Templates Smartsheet

Free Year End Report Templates Smartsheet

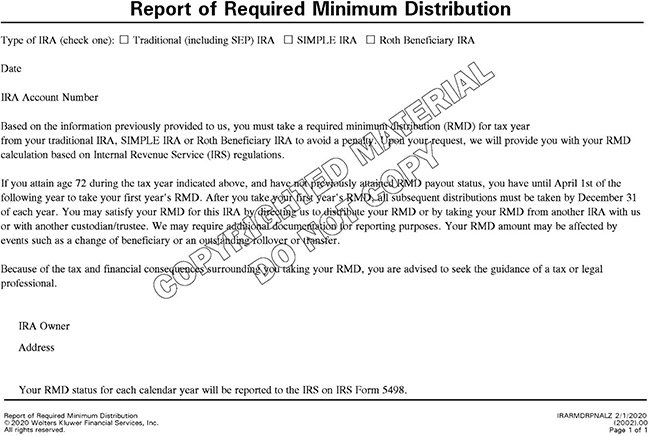

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

When And How To File Your Annual Accounts With Companies House Companies House

Individual Retirement Accounts 2021 Contribution Reporting On Irs Form 5498 Wolters Kluwer

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Ira Contribution Deadlines And Thresholds For 2022 And 2023 Smartasset

Year End Accounting For Limited Companies Made Simple

Us Tax Filling Deadlines And Important Dates Us Tax Law Services

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.07.48AM-240bfff397eb407f9736d065e74f55ec.png)

/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)